How does construction financing work?

What it takes to secure the financing you need to complete your project doesn’t need to be a mystery. We put together this video to explain how the financing process works, beginning with your blueprints through the completion of your custom built home, addition or remodeling project.

What questions do you need answered?

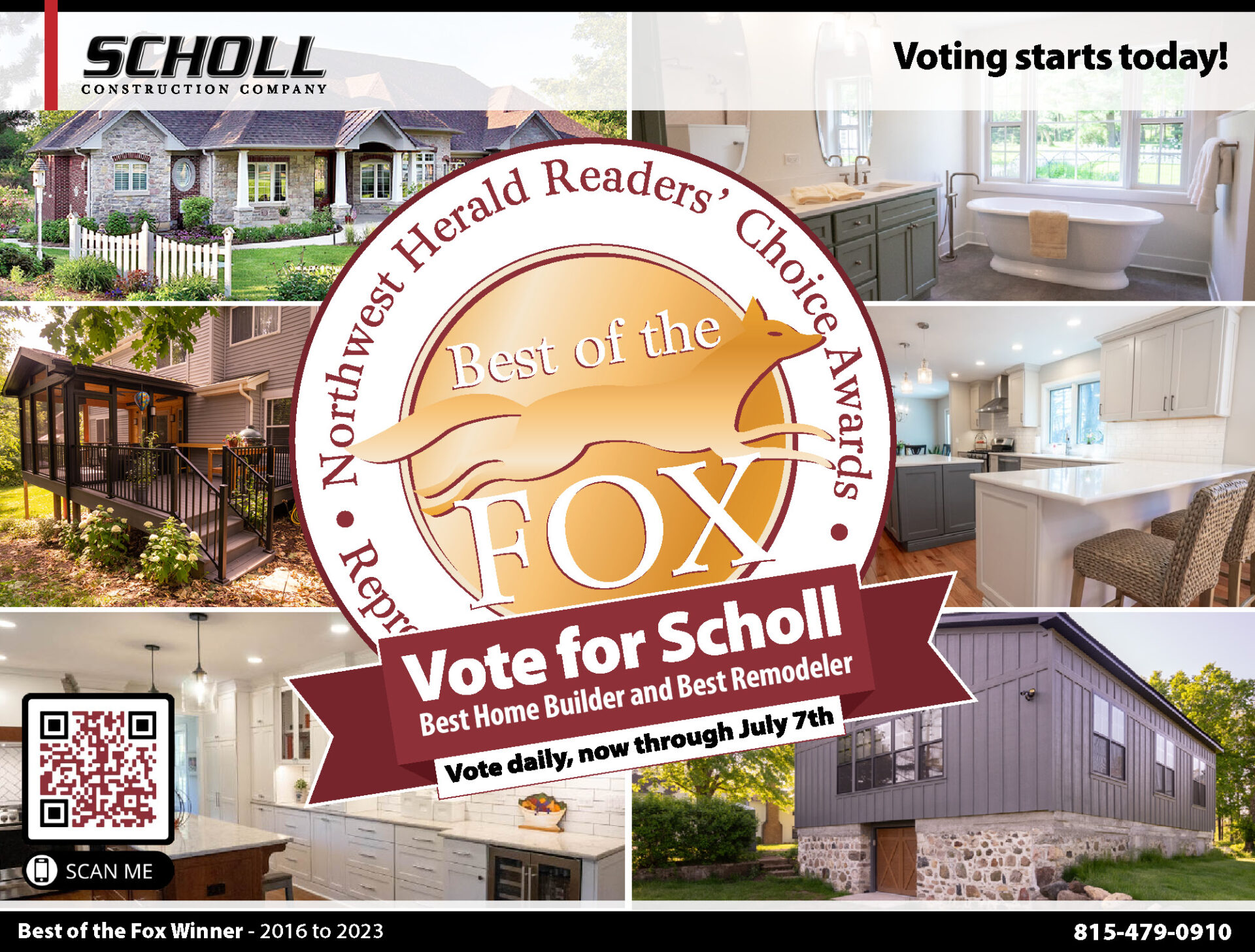

Scholl Construction is ready to answer all your questions to help make your vision a reality. Call us today at 815-479-0910 to get started, or contact us online to arrange an appointment.

Transcript

Can you explain how construction financing works?

I work with many local banks and to help my clients get construction financing. I’m going to need to be involved to get you the financing. They want what’s called a sworn statement, which is where we need blueprints. They do an appraisal on those blueprints. They take the value of the home that you’re going to build or in the case of remodeling or an addition, the value of your home, plus the renovations. What they’re looking for is typically 80%. I call it skin in the game. They want an 80% loan to value to give money to you need. I do work with a bank that can get a 90% loan to value for you. The way it works will develop your blueprints. We’ll send those to the bank, they’ll do an appraisal and then they’ll see how much money you need to put down versus how much money we need for the renovation or build the project.

And then we do monthly draws. I’ll do a month worth of work after we sign our contract and all the details are worked out, we work and get some of the materials ordered, we’ll do monthly draws. What happens there is, I do work like say, demolition or framing, then the bank comes in, they do an inspection, they sign off that it’s okay that I did everything right. The city comes in, they do their inspections, they sign off that we did everything right. And myself and my sub go to a title company, who is a third source that the bank will hire to hold the money in escrow and they disperse it as I complete the work. So, every month we’ll have an inspection; you’ll approve the payout as well as the bank, the title company and the city inspectors. Then everyone gets paid and we move on to the next months’ worth of work.

At the end of the building process, there are two ways you can handle converting your construction loan into a conventional mortgage. One is there are two closings, you’ll have a construction loan, then you close and then you’ll get a permanent mortgage. But the best way to do it is one loan where it’s a construction loan that turns into your permanent mortgage. At this point, you can set up whatever type of mortgage you want; a 30-year mortgage, 15-year mortgage, a 5-year arm. It’s just a conventional, typical mortgage that you’d have on any residential property.